Will established OEMs survive the EV revolution? (Part 2 of 2)

In Summary:

-

Incumbents face the dilemma of past investment, present revenue stream, and placing the future bet

-

The EV supply chain is very different to the current ICE engine

-

New business models are emerging, which makes the transition to EV difficult for OEMs

🤔 The Incumbent's Dilemma:

In management terms, this predicament is known as “Incumbent’s Dilemma”. Incumbents fail in spite of having several advantages over new entrants viz., Deep pockets, Wealth of customer data, Wide distribution network, the Best talent in the industry, Stellar brand image, etc. Ex-Harvard professor Clayton M Christensen argues that the very strength which makes the incumbent good in their current business model makes them bad at competing for disruption.

Key reasons for the Incumbent's Dilemma,

-

💸 Past Investment

The incumbents are heavily invested in the past, hence won't pursue anything that risks these investments. Who would want to disturb their own apple cart when the going is good. Let me explain this with a classic case: The first digital camera was actually invented by a Kodak engineer, but Kodak never pursued it as they saw this innovation as a threat to its film roll business. We all know what happened to Kodak after that, if you don’t disrupt your own business someone else will

-

💰 Present revenue stream

Here the principle of 80:20 plays a role; Business focus would always remain around activities that generate 80% of revenue and profits. The rest 20% is usually ignored. Activities that generate 80% of revenue are the current product & technologies. Future products & technology innovations would never be attractive to start with. Hence doesn't get enough attention/mindshare.

-

🔮 Placing the Future bet:

Whenever an industry faces a paradigm shift there are several options in front of it. For example, Auto industry had several technology possibilities to tackle pollution: 1) CNG, 2) Hybrids, 3) BioDiesel 4) Hydrogen fuel, 5) Fuel cell & 6) BEVs. Since the incumbent is not sure of where to place the bet, they end up investing smaller sums in a few of them, more to learn the technology than to seriously pursue it. Such a half hearted approach will never survive the onslaught of new entrants who put everything at their displosal on one technology/business model to win.

🏀⚽🏐Why EV is a different ball game:

In addition to all the above reasons which keeps the incumbent strongly attached to the past and present; new technologies like EVs pose special problems

-

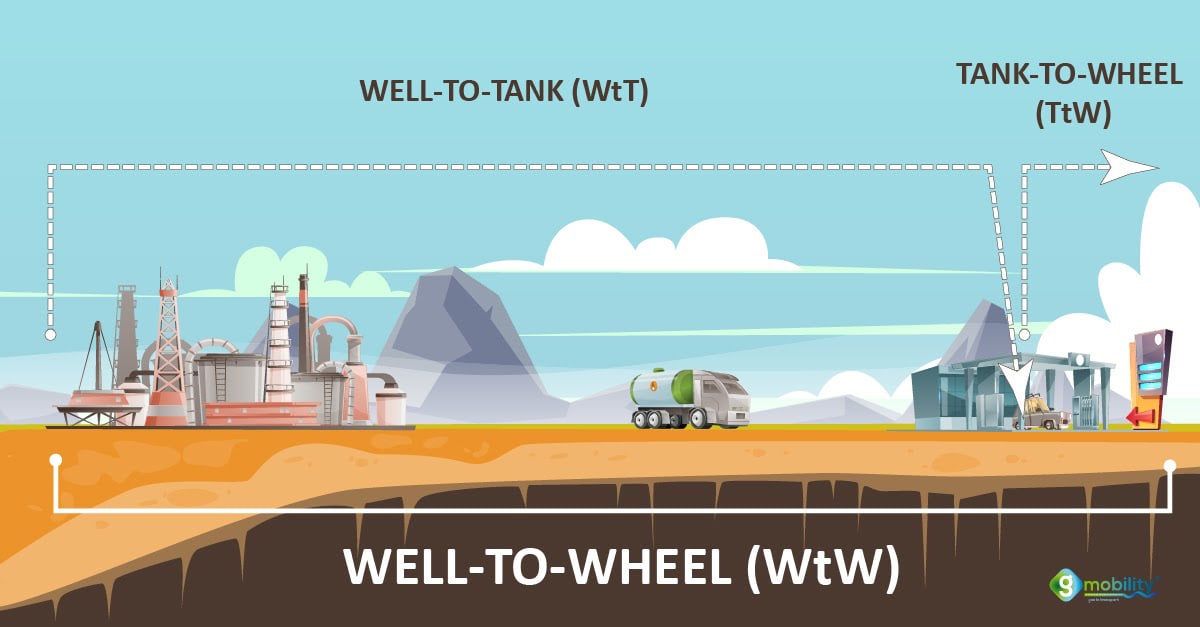

⚙️ Product & Supply chain mismatch - Electric motor technology is completely different from Internal Combustion Engines (ICE). Hence there is no synergy whatsoever. Plus the current Auto industry supply chain is machine shop focussed (Engine, fuel systems, gearbox, etc.), whereas the EV supply chain is electrical and electronics focussed. EV Motor, Power electronics, Battery & HV systems contribute to more than 50% of the cost of EVs

-

🏢 Reduced after-sales service requirement - Many of the OEM's dealer network depends on strong After-sales service revenue for their survival and growth; with less moving parts in an EV the frequency of service visits and the extent of servicing goes down drastically which will threaten the dominance of brand-exclusive dealerships & workshops in the Auto industry

-

⚡🏤 ⚡New & Emerging Business models - With EVs, the concept of one-time sales of products is changing. The subscription model is catching up, wherein customers subscribe for the car (like Netflix and Spotify) as long as they want. So instead of a one-time sales income, OEMs have to wait for 3-4 years to realize the full revenue of the product. Plus Features like over-the-air updates, Secondary life usage of battery, Vehicle to Grid application, etc. means continuous engagement with customers. This engagement is very different from the current model.

This may sound overwhelming, but that doesn’t mean that incumbent OEMs are doomed. Some (not all) will survive if they wake up at the right time and commit serious investment in EV technology and Business model.

There are examples in other industries where incumbents successfully survived disruptions; Microsoft is a classic case. They continuously re-invented themselves to dominate the digital world by entering Cloud business (Azure), Video conferencing (MS Teams), Social media (via LinkedIn buy out), and re-imagined the ubiquitous MS office into Office 360.

So all is not lost for incumbent OEMs, they still have time to catch up.

Hope you found this article useful. To receive automatic notification for our future articles, please don’t forget to subscribe below

Team "EV Quotient"

(EV Quotient is a platform to discuss and learn about electric vehicles. It’s an initiative by a team of experienced Automotive professionals with Global Exposure)